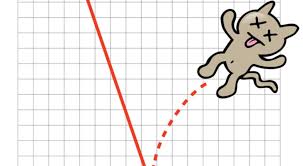

The “Dead Cat Bounce”

“A dead cat bounce is a temporary recovery from a prolonged decline or a bear market that is followed by the continuation of the downtrend. The name “dead cat bounce” is based on the notion that even a dead cat will bounce if it falls far enough and fast enough..” – Investopedia

The powers that rule the financial markets, The FED, the SEC, the World Bank, etc., all have one thing in common – they view Bitcoin as “the enemy” (The enemy of the Banks). While volatility rages in the Bitcoin price, any downturn – or upturn is regarded as proof that Bitcoin is a sham or fraud, like the “Dead Cat Bounce”.

Unfortunately for the large financial institutions, Bitcoin is far from dead. In fact, it is making a recovery from recent lows. Is the cat bouncing? You Bet it is. That sucker is going up and down like a yoyo. Count on it.

History teaches us that it takes 20 years to convert a financial fad into a trend, and a trend into an institution. Bitcoin started in 2009, and is a nine-year overnight success. The banks deride Bitcoin, but almost all of them are using the Blockchain technology (the underlying bitcoin technology) for developing low cost and stable transactions. With apologies to the Bard, “Methinks the banks protest too much”.

While the cat is bouncing, you can

1) Enjoy the show

2) Keep calm and HODL on

3) Buy on what looks like it may be a “low”, and sell some on what looks like a “high” (Note: it is generally agreed that no one can “time” the market, but with this much volatility, moving 20% in the course of a week, it could be a worthwhile risk – but don’t “bet the Farm” – know how much you can afford to lose, and keep Maalox handy).

Enjoy the show, Hold your coin and enjoy the highs, while avoiding despair when the price plunges and the Fat Cats project the “End of Bitcoin”.